INFORMATION REQUIRED IN PROXY STATEMENTSCHEDULE 14A INFORMATION

Filed by the Registrant | ||||||||

| | | ☒ | | | Filed by a Party other than the Registrant | | | ☐ |

| ☒ | Preliminary Proxy Statement |

☐ | Confidential, |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

As of the Abstentions and broker statement. vote on Proposal 1. listing of our common stock on The Nasdaq Capital Market or the NYSE American by authorizing our Board common stock. with such policies and practices to invest or handle trading in our common stock, but there can be no assurance in this regard. has any questions in this regard, stockholders are encouraged to contact their bank, broker or other nominee. reverse stock split and then received the cash in redemption of the fractional share. The deemed redemption generally results in capital gain or loss equal to the difference between the amount of cash received and the portion of the U.S. Holder’s tax basis in its common stock that is allocable to the fractional share. Such capital gain or loss is generally long-term capital gain or loss if the U.S. Holder’s holding period in its common stock surrendered exceeded one year at the effective time of the reverse stock split. The deductibility of capital losses is subject to limitations. same effect as a vote against Proposal 2. ACCOUNTING FIRM ACCOUNTING FIRM. Emmaus Medical. company’s financial reporting process, internal control system and disclosure control system. of Directors. Compensation Committee Governance and Nominations Committee company. Our Board of Directors believes that clarifies accountability for company business decisions and initiatives. Our Board of Directors, inquiry to a particular director if the inquiry is directed to a particular director; forward the inquiry to the appropriate personnel within our company (for instance, if it is primarily commercial in nature); attempt to handle the inquiry directly (for instance, if it is a request for information about our company or a stock-related matter); or not forward the inquiry, if it relates to an improper or inappropriate topic or is otherwise irrelevant. any other person. George Carpenter(1) President and Chief Executive Officer Paul Buck(2) Chief Financial Officer and Secretary Robin L. Smith(3) Chairman of the Board of Directors John Pappajohn(4) Director Robert J. Follman(5) Director Zachary McAdoo(6) Director Andrew H. Sassine(7) Director Michal Votruba(8) Director Geoffrey E. Harris(9) Director Non-Director 5%+ Stockholders: CNS RESPONSE,Itsits Charter)(Name of Person(s) Filing Proxy Statement, if other than the Registrant)☒ No Fee Required☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.(1) Title of each class of securities to which transaction applies:(2) Aggregate number of securities to which transaction applies:(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):(4) Proposed maximum aggregate value of transaction:(5) Total fee paid:☐ Fee paid previously with preliminary materials:☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.(1) Amount previously paid:(2) Form, Schedule or Registration Statement No.:(3) Filing party:(4) Date filed: CNS RESPONSE,

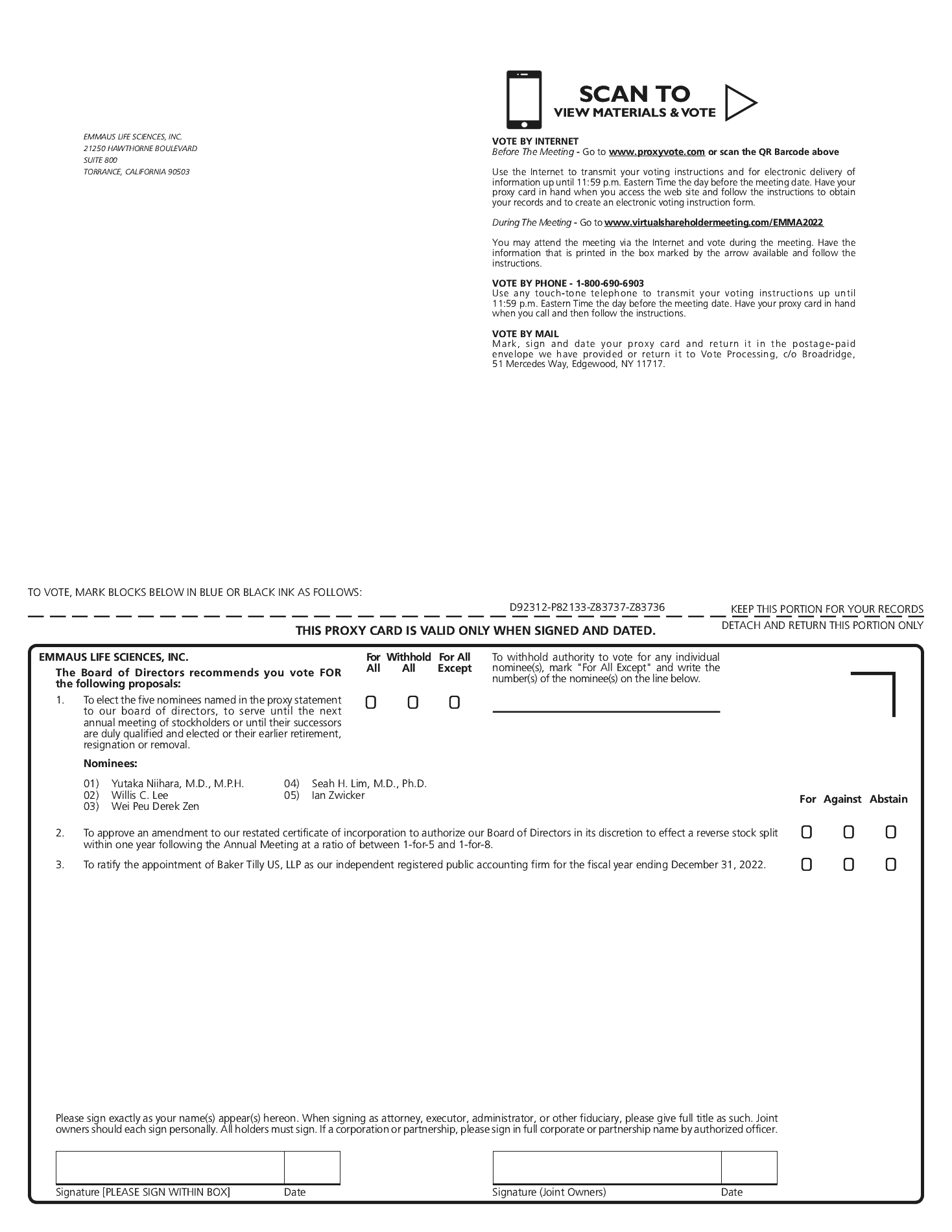

85 Enterprise,410800Aliso Viejo, CA 92656September [X], 2015You are cordially invited to attend theof CNS Response, Inc. (the “Company”) to be held on Wednesday, October 28, 2015December 8, 2022, at 11:2:00 a.m.p.m. (Pacific time), EDT, at 420 Lexington Avenue, Suite 350, New York, NY 10170. At this meeting, CNS stockholders will vote onfor the following proposals:purposes, as more fully described in the accompanying proxy statement:1. 1)To elect the five nominees named in this proxy statement to elect seven directorsour Board of Directors, to serve until the next annual meeting of stockholders and until their respective successors are elected and qualified (referredor their earlier death, resignation, disqualification or removal;2. To approve an amendment to as “Proposal No.1”);2)our restated certificate of incorporation to amend the Company’s Amended and Restated Certificateauthorize our Board of Incorporation, as amended (the “Charter”)Directors in its discretion to change the name of the Company from “CNS Response, Inc.” to “MYnd Analytics, Inc.” (referred to as “Proposal No. 2” or the “Name Change Proposal”);3)to amend the Charter to increase the number of shares of common stock, par value $0.001 per share (“Common Stock”), authorized for issuance under the Charter from 180,000,000 to 500,000,000 (referred to as “Proposal No. 3” or the “ Authorized Share Amendment Proposal”);4)to amend our Charter for the purposes of effectingeffect a reverse stock split of the outstanding shares of our Common Stock bycommon stock within one year following the annual meeting at a ratio of not less than 1-for-10between 1-for-5 and not more than 1-for-200, and to authorize the board of directors to determine, at its discretion, the timing of the amendment and the specific ratio of the reverse stock split (referred to as “Proposal No. 4” or the “Reverse Stock Split Proposal”);1-for-8;3. 5)toTo ratify the selection by the Audit Committeeappointment of Anton & ChaiBaker Tilly US, LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2015 (referred to as “Proposal No. 5”);December 31, 2022; and4. 6)toTo transact such other business as may properly come before the Annual Meeting, andor any meeting following postponement or adjournment thereof.thereof by or at the direction of our Board of Directors.I hopehttps://www.virtualshareholdermeeting.com/EMMA2022 and entering the 16-digit control number included on the accompanying proxy card, where you will be able to listen to the meeting live, submit questions, view the stockholder list, and vote online. Because the meeting is completely virtual and being conducted via the Internet, stockholders will not be able to attend the meeting in person. Instructions for attending the annual meeting and voting your shares are included in person. We consider the votesaccompanying proxy statement. Our board of alldirectors has fixed the close of ourbusiness on October 19, 2022, as the record date for the annual meeting. Only stockholders of record at the close of business on such date are entitled to benotice of and to vote at the annual meeting.whether you own a few shares or many.to us. Whether or not you plan to attend the annual meeting, please vote your shares as soon as possible,by following the voting instructions contained in the proxy statement. We look forward to your participation.

enclosedWHITEAnnual Meeting by visiting https://www.virtualshareholdermeeting.com/EMMA2022 and entering the 16-digit control number included on your proxy card. Thiscard, where you will ensure that your shares are represented atbe able to listen to the meeting whether orlive, view the stockholder list, submit questions and vote online. Because the Annual Meeting is completely virtual and being conducted via the Internet, stockholders will not you arebe able to attend in person. Of course, if you do attend the meeting and wish to vote in person, you may do so.Your vote is extremely important. You may vote your shares by mail, fax or email by completing, signing, dating and returning theWHITE proxy card in the postage-paid envelope provided or by scanning or faxing the proxy card to CNS at the email address and fax numbers indicated in the accompanying proxy statement. You may revoke your proxy at any time before it is exercised at our annual meeting by following the instructions in the proxy statement.Very truly yours,/s/ George CarpenterGeorge CarpenterPresident and Chief Executive OfficerCNS RESPONSE, INC.85 Enterprise, Suite 410Aliso Viejo, CA 92656NOTICE OF ANNUAL MEETING OF STOCKHOLDERSNOTICE IS HEREBY GIVEN thatAdditional information about the Annual Meeting, of Stockholders of CNS Response, Inc. (“CNS”) willincluding how to submit questions and what to do if you encounter technical problems accessing the meeting, can be found below under “Virtually Attending the Annual Meeting.” at 420 Lexington Avenue, Suite 350, New York, NY 10170, on Wednesday, October 28, 2015 at 11:00 a.m., EDT, for the purpose of considering and acting on the following matters:purposes, which are sometimes referred to herein as “Proposals”:1. 1)To elect the five nominees named in this proxy statement to elect seven directorsour Board of Directors, to serve until the next annual meeting of stockholders and until their respective successors are elected and qualified (referredor their earlier death, resignation, disqualification or removal;2. To approve an amendment to as “Proposal No.1”);2)our restated certificate of incorporation to amend the Company’s Amended and Restated Certificateauthorize our Board of Incorporation, as amended (the “Charter”)Directors in its discretion to change the name of the Company from “CNS Response, Inc.” to “MYnd Analytics, Inc.” (referred to as “Proposal No. 2” or the “Name Change Proposal ”)3)to amend the Company’s Charter to increase the number of shares of common stock, par value $0.001 per share (“Common Stock”), authorized for issuance under the Charter from 180,000,000 to 500,000,000 (referred to as “Proposal No. 3” or the “Authorized Share Amendment Proposal ”);4)to amend the Company’s Charter for the purposes of effectingeffect a reverse stock split of the Company’s Common Stock byoutstanding shares of our common stock within one year following the Annual Meeting at a ratio of not less than 1-for-10between 1-for-5 and not more than 1-for-200, and to authorize the board of directors to determine, at its discretion, the timing of the amendment and the specific ratio of the reverse stock split (referred to as “Proposal No. 4” or the “Reverse Stock Split Proposal ”).1-for-8;3. 5)toTo ratify the selection by the Audit Committeeappointment of Anton & ChaiBaker Tilly US, LLP as the Company’sour independent registered public accounting firm for the fiscal year ending September 30, 2015 (referred to as “Proposal No. 5”);December 31, 2022; and4. 6)toTo transact such other business as may properly come before the Annual Meeting andor any meeting following postponement or adjournment thereof.thereof by or at the direction of our Board of Directors.These items are more fully described in theNotice.The boardproxy statement, the accompanying proxy card, our stockholder list and our Annual Report are available online at https://www.virtualshareholdermeeting.com/EMMA2022.directorsDirectors has fixed the close of business on Friday, September 18, 2015,October 19, 2022 as the record date (“Record(the “Record Date”) for determining CNS stockholdersthe determination of holders of our common stock entitled to notice of and to vote at the annual meeting andAnnual Meeting or any adjournment or postponement thereof.Your vote is extremely important. All CNS stockholders are cordially invited to attend the annual meeting in person. Whether or not you plan to attend in person, you are urged to mark, date, sign and return the enclosedWHITE proxy card as promptly as possible in the postage-prepaid envelope provided, or scan or fax your completed proxy card to the email address and fax numbers indicated in the proxy statement — this will help ensure that your CNS shares are represented and that a quorum is present at the annual meeting. If you submit your proxy and then decide to attend the annual meeting and wish to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures identified in the accompanying proxy statement. Only CNS stockholders of record at At the close of business on Friday, September 18, 2015 arethe Record Date, we had 49,558,501 shares of common stock issued and outstanding.noticecast one vote with respect to each of the director-nominees and each of the other Proposals for each share of common stock held on the Record Date.annual meeting. This proxy statement andAnnual Meeting by the following means:are first being distributed to stockholderscomplete an electronic proxy card. You will be asked to provide the company number and control number on or about September 28, 2015.the proxy card. Your electronic proxy card must be completed by 11:59 p.m. (Eastern time) on December7, 2022, for your shares to be voted at the Annual Meeting.Important Notice Regarding Internet Availability of Proxy Materials For TheDuring the Annual Meeting. Access the Annual Meeting Of Stockholders: This proxy statement,and vote online at https://www.virtualshareholdermeeting.com/EMMA2022. You may vote online at the accompanying form ofAnnual Meeting even if you have already submitted a proxy card and CNS’s Annual Report (the “Annual Report”)or electronic proxy card.Form 10-K are available atwww.cnsresponse.com. We are providing you access to our proxy materials both by sending you this full set of proxy materials and by notifying you of the availability of our proxy materials on the Internet.If you have any questions or require any assistance with voting your shares, please contact:Paul Buck, CFOCNS Response, Inc.pbuck@cnsresponse.comBy order of the Board of Directors,/s/ Paul BuckPaul BuckSecretaryAliso Viejo, CaliforniaSeptember [28], 2015IMPORTANT: Whether or not you expect to attend the annual meeting in person, we urge you to submit a completed WHITE proxy card to vote your shares. This will help ensure the presence of a quorum at the annual meeting. Promptly voting your shares will help to save CNS the expense of additional solicitations. As described in the accompanying proxy statement, submitting your WHITE proxy card now will not prevent you from voting your shares at the annual meeting if you desire to do so. Please mailDecember 7, 2022. Have your proxy card in hand when you call and then follow the instructions.faxby facsimile as instructed on the proxy card to CNS1-866-867 4446the Annual Meeting and at any adjournments or to American Stock Transfer & Trust Company at 1-718-765-8730.CNS RESPONSE, INC.TABLE OF CONTENTSTHIS PROXY STATEMENT ALSO INCLUDES THE WHITE PROXY CARD FOR YOUR USE IN VOTING FOR THE ELECTION OF DIRECTORS, THE AMENDMENTS OF THE COMPANY’S CHARTER WITH REGARD TO AUTHORIZED COMMON STOCK AND THE RATIFICATION OF THE INDEPENDENT AUDITORS.CNS RESPONSE, INC.

85 Enterprise, Suite 410Aliso Viejo, CA 92656PROXY STATEMENTANNUAL MEETING OF STOCKHOLDERSTO BE HELD OCTOBER 28, 2015ABOUT THE MEETINGThis proxy statement is furnishedpostponements thereof in connectionaccordance with the solicitation of proxies byinstructions contained in the board of directors (the “Board”proxy card. If a stockholder executes and returns a proxy card or “Board of Directors”) of CNS Response, Inc., a Delaware corporation (“CNS,” the “Company,” “we,” “our,” or “us”) for use in connection with CNS’s annual meeting of stockholders (the “annual meeting” or the “meeting”), to be held on Wednesday, October 28, 2015 at 11:00 a.m., EDT, at 420 Lexington Avenue, Suite 350, New York, NY 10170. This proxy statement, the enclosedWHITEcompletes an electronic proxy card and does not specify otherwise, the Company’s 2014 Annual Report on Form 10-K are being sent to stockholders entitled to vote atshares represented by the annual meeting.THE BOARD OF DIRECTORS URGES YOU TO RETURN THE WHITE PROXY CARD AS SOON AS POSSIBLE.QUESTIONS AND ANSWERS REGARDING THE ANNUAL MEETINGWhy am I receiving these materials?We are sending you this proxy statement because the Board is soliciting your proxy to vote at our annual meeting. This proxy statement provides information regarding the matters that we will act on at the annual meeting and summarizes the information you need in order to vote at the annual meeting. You do not need to attend the annual meeting to vote your shares of our common stock, par value $0.001 per share (“Common Stock”). Please read this proxy statement, as it contains important information you need to know to vote at the annual meeting.When and where will the annual meeting take place?The annual meetingcard will be held on Wednesday, October 28, 2015 at 11:00 a.m., EDT, at 420 Lexington Avenue, Suite 350, New York, NY 10170.Who is soliciting my vote?This proxy statementvoted “FOR” the election as directors of the five nominees identified herein and theWHITE proxy card are provided in connection with the solicitation of proxies by our Board for the annual meeting. Proxy materials, including this proxy statement“FOR” Proposals Nos. 2 and theWHITE proxy card, were filed by us with the Securities3, and Exchange Commission on September [X], 2015, and we are first making this proxy statement available to stockholders on or around September 28, 2015.What am I being asked to vote on?At the annual meeting, stockholders of record as of September 18, 2015 will be entitled to vote in the election of directors (referredproxy holders’ discretion with respect to as “Proposal No.1”). Our nominees for director are:• Robin Smith• John Pappajohn• Robert Follman• Andrew Sassine• Zachary McAdoo• Michal Votruba• Geoffrey HarrisAt this meeting, CNS stockholders will vote on the proposal to amend our Amended and Restated Certificate of Incorporation, as amended (the “Charter”) to change the name of the Company from “CNS Response, Inc.” to “MYnd Analytics, Inc.” (referred to as “Proposal No. 2” or the “Name Change Proposal”)Furthermore, CNS stockholders will also vote to on the proposal to approve an amendment to the Company’s Charter to increase the number of shares of Common Stock authorized for issuance under the Charter from 180,000,000 to 500,000,000 (referred to as “Proposal No. 3” or the “Authorized Share Amendment Proposal”).Additionally, CNS stockholders will vote on the proposal to amend our Charter to effect a reverse stock split of our Common Stock, by a ratio of not less than 1-for-10 and not more than 1-for-200, and to authorize the Board to determine, at its discretion, the timing of the amendment and the specific ratio of the reverse stock split (referred to as “Proposal No. 4” or the “Reverse Stock Split Proposal”).Penultimately, CNS stockholders will vote to ratify the selection by the Audit Committee of Anton & Chia LLP as our independent registered accounting firm for the fiscal year ending September 30, 2015 (referred to as “Proposal No. 5”).Finally, CNS stockholders will transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. meeting following postponement or adjournment thereof.How does the Board recommend that I vote?Our Board believes that it is in the best interest of CNS and its stockholders to approve the following:OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF OUR DIRECTOR NOMINEES (PROPOSAL 1).OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE NAME CHANGE PROPOSAL TO CHANGE THE NAME OF THE COMPANY TO “MYnd ANALYTICS, INC.” (PROPOSAL 2)OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE AUTHORIZED SHARE AMENDMENT PROPOSAL TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 180,000,000 SHARES TO 500,000,000 SHARES (PROPOSAL 3).OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE REVERSE STOCK SPLIT PROPOSAL, TO BE EFFECTED AT A SPECIFIC RATIO WITHIN A RANGE FROM 1 FOR 10 TO 1 FOR 200, AND TO AUTHORIZE THE BOARD OF DIRECTORS TO DETERMINE, AT ITS DISCRETION, THE TIMING OF THE AMENDMENT, IF ANY, AND THE SPECIFIC RATIO OF THE REVERSE STOCK SPLIT (PROPOSAL 4).OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF OUR INDEPENDENT REGISTERED ACCOUNTING FIRM (PROPOSAL 5).How are my shares of Common Stock voted if I give you my proxy?Unless you give other instructions on yourWHITE proxy card, the persons named as proxy holders on theWHITE proxy card will vote in accordance with the recommendations of our Board. This means that if you return an executedWHITEproxy card to us and:do not withhold authority to vote for the election of any of the director nominees, all of your shares of Common Stock will be voted for the election of each director nominee;withhold authority to vote your shares of Common Stock for any director nominee, none of your shares of Common Stock will be voted for that candidate, but all of your shares of Common Stock will be voted for the election of each director nominee for whom you have not withheld authority to vote;do not specify how to vote on any of the Proposals numbered 2 through 5, your shares will be voted “FOR” such proposals.The above description is subject to the “broker non-vote” limitation described under “How do I vote?” below.Who may vote at the annual meeting?Our Common Stock is the only class of voting shares. Holders of record of our Common Stock at the close of business on September 18, 2015, the Record Date for the annual meeting, are entitled to vote on each matter properly brought before the annual meeting and at any adjournment or postponement of the meeting.How many votes do I have?CNS stockholders have one vote for each share of Common Stock owned on the Record Date on each matter properly brought before the annual meeting and at any adjournment or postponement of the meeting.How many votes may be cast by all stockholders?closedate of this proxy statement, we know of no business on September 18, 2015, 101,667,409 sharesother than the Proposals that will be presented for action at the Annual Meeting. All proxy cards, whether received prior to or after the original date of our Common Stock were outstandingthe Annual Meeting, will be valid as to any postponement or adjournment of the Annual Meeting.each shareBroker Non-Votesonevote.each matter properly brought beforea particular Proposal because the annual meeting and at any adjournment or postponement of the meeting.How do I vote?You may vote by attending the annual meeting and voting in person or by submitting a proxy. The method of voting by proxy will be different depending on whether your shares are held by you directly as the record (or registered) holder or if your shares are held in “street name” by a broker, bank or nominee on your behalf.•Record holders: If you hold your CNS shares as a record holder, you may vote your shares by completing, dating and signing theWHITE proxy card that is included with this proxy statement and promptly returning it in the pre-addressed, postage paid envelope we are providing to you. You also have the option of submitting your proxy electronically via email or by fax by following the instructions described below. You also have the right to vote in person at the meeting, and if you choose to do so, you can bring the enclosedWHITE proxy card or vote using the ballot provided at the annual meeting.If you vote by proxy, your shares will be voted at the annual meeting in the manner specified by you, if any. If you sign, date and return yourWHITE proxy card, but dohas not specify how you want your shares voted, they will be voted by the proxy holder as described under “How are my shares of Common Stock voted if I give you my proxy?”•“Street name” holders: If you hold your CNS shares in street name, you are what is commonly known as a “beneficial owner,” and you should receive a notice from your broker, bank or other nominee that includes instructions on how to vote your CNS shares. Your broker, bank or nominee may allow you to deliver your voting instructions over the Internet and may also permit you to vote by telephone. You also may request paper copies of the proxy statement andWHITE proxy card from your broker. Because a beneficial holder is not the stockholder of record, you may not vote these shares in person at the annual meeting unless you obtain a “legal proxy” from the broker, bank or other nominee that holds your shares, giving you the right to vote the shares at the meeting.If you hold your shares in street name and do not provide your broker with specificreceived voting instructions regardingfrom the election of directors, the broker will not be able to vote your shares on your behalf with respect to Proposals 1, 2, 3beneficial owner and 4 because the broker does not have discretionary authority to vote on certain non-routine items, such as director elections, charter amendments and the adoption of equity incentive plans (so-called “broker non-votes”) — the broker must receive votingshares with respect to that Proposal. Brokers generally have discretionary authority to vote without specific instructions from you astheir customers on routine matters only. Proposals are deemed to be routine or non-routine matters based on the beneficial ownerrules of the shares.Even ifvarious regional and national exchanges of which your broker is a member. On any non-routine matter for which you plando not give your broker instructions to attend the annual meeting, we ask that you vote your shares, in advance using the WHITE proxy card so that your voteshares will be counted if you later decidetreated as broker non-votes and will be deemed to be not entitled to attendvote on the annual meeting.To vote for our nominees — Robin Smith, John Pappajohn, Robert Follman, Zachary McAdoo, Andrew Sassine, Geoffrey Harris and Michal Votruba — andmatter.Proposals 2 through 5, you must followan amendment to our restated certificate of incorporation, and Proposal 3, to ratify the instructionsappointment of Baker Tilly US, LLP as our independent registered public accounting firm, are expected to be considered routine matters. Proposal 1, the election of directors, is expected to be considered a non-routine matter on theWHITE proxy card or attendwhich brokers will not have discretionary authority to vote.annual meeting in personeffect of abstentions and broker non-votes on the outcome of the vote by written ballot.If you have any questions about howon each Proposal, please refer to ensure that yourthe discussion of each Proposal.areof our common stock entitled to be voted at the annual meeting in accordance with your wishes, please contact:George Carpenter CEO CNS Response, Inc. gcarpenter@cnsresponse.comCan I send in my proxy by fax or by email?Yes. You may fax your completed and signed proxy card to us at (866) 867 4446. You also may fax your completed and signed proxy card to American Stock Transfer & Trust Company at 718-765-8730. You also may email a completed and signed proxy card to us by scanning your completed and signed proxy card and emailing it to the attention of Paul Buck atpbuck@cnsresponse.com.How many votesAnnual Meeting must be present to hold the annual meeting?A quorum must be present for business to be transacted at the annual meeting. The presence in person or by proxy of the holders of a majority of the outstanding shares of our Common Stock entitled to vote at the annual meeting will constitute a quorum for the transaction of business at the annual meeting. Based on shares of our Common Stock outstanding on the Record Date, 50,833,705 shares of our Common Stock must be present either in person or by proxy for a quorum to be present and for any action to be taken at the Annual Meeting. If you submit a properly executed proxy, regardless of whether you abstain from voting on one or more Proposals, your shares will be counted as present at the Annual Meeting for the purpose of determining the presence of a quorum.“non-votes” are countednon-votes also will be treated as present and entitled to vote for purposes of determining the presence or absence of a quorum. A broker “non-vote” occurs when a broker or nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker or nominee does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. In order for us to determine that enough votes will be present to hold the annual meeting and transact business, we urge you to vote as soon as possible by submitting theWHITE proxy card.What vote is required to elect the directors?WhenIf a quorum is not present a pluralityat the time of the votes cast byAnnual Meeting, we expect that the stockholders entitledAnnual Meeting will be adjourned to vote at the election of directors is requiredallow for the electionsolicitation of directors. This means thatadditional proxies.seven nominees receiving the highest numbersolicitation of affirmative votes will be electedproxies. In addition to the Board. There is no cumulative voting in the election of directors.What vote is required to approve the other proposals put before the Stockholders?When a quorum is present, the affirmative vote of a majority of the votes presentsolicitation by mail, our directors, officers, and employees may solicit proxies from our stockholders in person or represented by proxy and entitled to vote on the matter,telephone, facsimile, e-mail, or other electronic means without additional compensation other than reimbursement for any expenses they may incur. If applicable, arrangements also will be required to approve eachmade with brokerage firms and other custodians, nominees, and fiduciaries for the forwarding of the proposals put beforeproxy materials to the beneficial owners of shares held of record by them, and we will reimburse such brokerage firms, custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses incurred in connection therewith. We also may determine to retain a proxy solicitor to assist in soliciting proxies for a fee that we estimate would not exceed $25,000 plus reimbursement of certain expenses.A quorumThis process, which is represented by 50,833,705commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies. If you hold shares of our common stock in your own name as a holder of record, “householding” will not apply to your shares.101,667,409 issued and outstanding at the close of business on the Record Date, September 18, 2015.May I revoke my vote?You mayproxy materials. Once you have received notice from your broker that they will be “householding” materials to your address, householding will continue until you are notified otherwise or until you revoke your voteconsent. If at any time before youryou no longer wish to participate in householding and would prefer to receive separate proxy is voted at the annual meeting. The action you must take to revoke your vote will be different depending on whether your shares are held by you directly as the record holdermaterials, or if your sharesyou are held in “street name” by a broker, bank or nominee on your behalf.• Record holders: If you hold your CNS shares as a record holder, you may revoke your proxy at any time before your proxy is voted at the annual meeting by (i) delivering to CNS a signed written notice of revocation, bearing a date later than the datereceiving multiple copies of the proxy stating that the proxy is revoked, (ii) signing and delivering a new paper proxy, relating to the same shares and bearing a later date than the original proxy, (iii) submitting another proxy by email or fax relating to the same shares and bearing a later date than the original proxy, or (iv) attending the annual meeting and voting in person, although attendance at the annual meeting will not, by itself, revoke a proxy.• “Street name” holders: If you hold your CNS shares in street name, you may change your vote by submitting new voting instructions to your broker, bank or other nominee. You must contact your broker, bank or other nominee to find out how to do so.Will any other business be conducted at the annual meeting?It is not currently expected that any matter other than those identified above will be voted upon at the annual meeting (other than procedural matters with respect to the conduct of the meeting that may properly arise). With respect to any other matter that properly comes before the meeting, the proxy holders will vote as may be recommended by our Board or, if no recommendation is given, in their own discretion.May I vote in person?Yes. If you plan to attend the annual meetingmaterials and wish to vote in person, you will be given a ballot at the annual meeting. Please note, however, thatreceive only one, please notify your broker or bank if your shares are held in street name, you must bring to the annual meeting a “legal proxy” from the record holdername.shares, which isAnnual Meetingbroker, bank or other nominee, authorizing you to votepreliminary voting results at the annual meeting.What do I need for admissionAnnual Meeting and publish the final results in a Current Report on Form 8-K to be filed with the annual meeting?You are entitled to attend the annual meeting in person only if you are a stockholder of record or a beneficial owner of our stock asSEC no later than December 14, 2022. A copy of the close of businessForm 8-K will be available on September 18, 2015, or if you hold a valid proxy for the annual meeting. To attend the meeting, you must bring with you:photo identification; andif you hold in “street name,” you should provide proof of beneficial ownership on the Record Date,our website at http://www.emmausmedical.com. You can also get a copy of theWHITE voting-instruction card provided by your broker, bank, or other nominee, or other similar evidence of ownership as of the Record Date, Form 8-K, as well as your photo identification.If you areother reports we file with the stockholder of record, your name will be verified againstSEC, through the listInternet site maintained by the SEC at http://www.sec.gov.of record priorby submitting their proposals in writing to your admittanceour Corporate Secretary in a timely manner. For a stockholder proposal to the annual meeting.The use of cameras, recording devices and other electronic devices at thebe considered for inclusion in our proxy statement for our 2023 annual meeting is prohibited, and such devices willof stockholders, our Corporate Secretary must receive the written proposal at our principal executive offices not be allowed inlater than 120 days before the meeting or any other related areas, except by credentialed media. We realize that many cellular phones personal digital assistants have built-in digital cameras and voice recorders, and while you may bring these into the meeting venue, you may not use the camera or recording function at any time.What happens if the annual meeting is postponed or adjourned?Your proxy will remain valid and may be voted when the postponed or adjourned meeting is held. You may change or revoke your proxy until it is voted.Who pays for the solicitationdate of proxies?We will pay the cost of preparing this proxy statement, and the relatedWHITE proxy card and notice of meeting, as well as any other materials that may be distributed on behalf of our Board, and any cost of soliciting your vote on behalf of the Board. We also pay all annual meeting expenses.We may use the services of our directors, officers, employees and others to solicit proxies, personally or by mail, telephone, or facsimile. We may also make arrangements with brokers, banks and other custodians, nominees, fiduciaries and stockholders of record to forward solicitation material to the beneficial owners of stock held of record by such persons. We may reimburse such individuals or firms for reasonable out-of-pocket expenses incurred by them in soliciting proxies, but we will not pay any compensation for their services. We estimate that our total expenditures related to the solicitation of proxies for the annual meeting will be approximately $25,000. Although unlikely, we may decide to engage a proxy solicitation firm to assist, 2023. In addition, stockholder proposals must comply with the solicitationrequirements of proxies in which case the additional cost of the proxy solicitation firm to be borne by us will be approximately $10,000.May I access the proxy materials for the annual meeting on the Internet?Under recently implemented rulesRule 14a-8 of the Securities Exchange Act of 1934 regarding the inclusion of stockholder proposals in issuer proxy materials. Proposals should be addressed to:Exchange Commission, we are providing accessNominations Committee nominees for election to our proxy materials bothBoard of Directors by sendingcomplying with the procedures set forth in the Governance and Nominations Committee Charter, which require, among other things, that such nomination be in writing, contain specified information regarding the nominee and be received by the company by the deadline for submitting stockholder proposals referred to above.this full setwould like to recommend the nomination of proxy materials, includingsomeone for election to our Board of Directors at our 2023 annual meeting, please review theWHITE proxy card, Governance and by notifying you of the availability of our proxy materialsNominations Committee Charter, which is available on the Internet. Thiscompany’s website at www.emmausmedical.com. For additional information regarding stockholder recommendations for director candidates, see “Board of Directors and Corporate Governance — Stockholder Recommendations” in this proxy statement, the accompanying form ofWHITE proxy card and the Company’s Annual Report on Form 10-K (as amended) for the fiscal year ended September 30, 2014 are available atwww.CNSResponse.com.Proposal No. 1 is forsevenfive directors to hold officeserve until ourthe next annual meeting of stockholders and until their respective successors have been dulyare elected and qualified.qualified or their earlier death, resignation, disqualification or removal. Our Charter provides thatBoard of Directors has nominated Yutaka Niihara, M.D., M.P.H., Willis C. Lee, Wei Peu Derek Zen, Seah H. Lim, M.D., Ph.D., and Ian Zwicker for election as directors at the number ofAnnual Meeting.Company shall be fixed from timecompany and have indicated their willingness and ability to time by our Board. The Board has fixed the number of directors at seven.Unless otherwise instructed, the proxy holders will vote the proxies received by them “FOR” all of the nominees named below.serve as directors. If any nominee isbecomes unwilling or unable or unwilling to serve, as a director at the time of the annual meeting, the proxiesyour proxy will be voted for such other nominee(s)an alternative nominee of our present Board of Directors. You can find information about the nominees in the “Board of Directors and Executive Officers” section, below.shall be designated byto any or all the boardnominees. The affirmative vote of a plurality of votes cast with respect to the election of directors to fill any vacancy, or, alternatively,is required for the Board may determine to reducenominees’ election. In other words, the number of directors. We have no reason to believe that any nominee will be unable or unwilling to serve if elected as a director.Proxies may not be voted for more than seven directors. The sevenfive nominees receiving the highest number of affirmative votes cast with respect to the election of the shares entitled to vote at the meetingdirectors will be elected. Stockholders may nothave no right to cumulate their votes in the election of directors.The Board has nominated Unless otherwise instructed thereon, properly executed proxy cards and proposes theelectronic proxy cards returned or completed in a timely manner will be voted “FOR” election of the followingfive nominees named above. Votes withheld and broker non-votes will not be counted as directors:•Robin Smith•John Pappajohn•Robert Follman•Andrew Sassine•Zachary McAdoo•Michal Votruba•Geoffrey HarrisThe principal occupationvotes cast and certain other information aboutwill have no effect on the nominees and certain executive officers are set forth under “Information Regardingoutcome of the Board of Directors and Committees and Company Management.”Board RecommendationTHE ELECTION OF THE NOMINEES LISTED ABOVE.